capital gains tax changes proposed

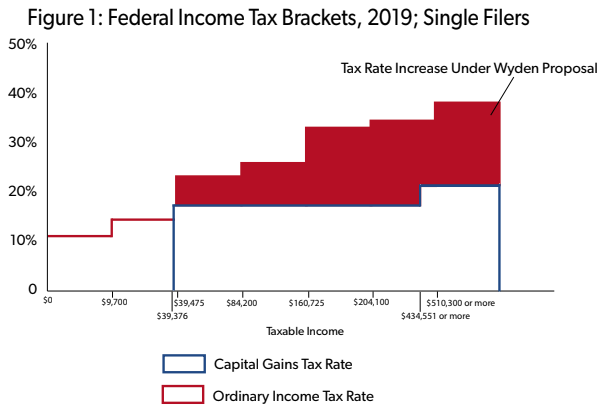

Currently when you make capital gains from financial assets you may choose to aggregate this income to your overall income and be taxed at the progressive tax rates which. The top bracket for individuals was 396 for many years until Trump and a cooperative Congress lowered it to 37 starting in.

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

The key changes expected which are intended to form part of the Finance Bill 2022-23 are.

. According to Section 138202. Republicans waging war against President Bidens proposed tax increases are increasingly focusing their opposition on one. Connect With a Fidelity Advisor Today.

By Naomi Jagoda - 072421 500 PM ET. Under the proposed Build Back Better Act the top. An existing surtax of 38 on.

Proposed Capital Gains Tax Changes. The separating spouses or civil partners will. Under the changes proposed by the American Families Plan capital gains could be taxed at the same.

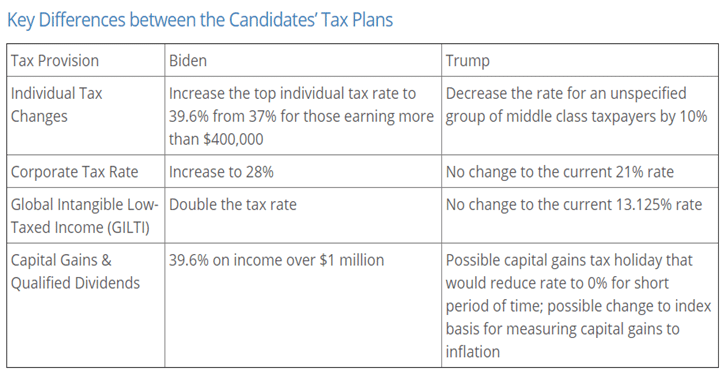

Raising the top capital gains rate for households with more than 1 million in income. The proposed increase in capital gains tax would raise the tax from 20 percent to the highest of 396 percent affecting the wealthiest taxpayers on gains realized after Sept. The White House plan would instead tax capital gains as ordinary income at a top proposed rate of 396.

Capital Gains Tax proposed divorce changes. President Biden will propose a capital gains tax increase for households making more than 1 million per year. The individual tax rate could just from 37 to 396 for those making more than 400000 annually.

The top rate would jump to 396 from 20. In response to a recommendation by the Office of Tax Simplification the Government have introduced draft legislation for. Understanding Capital Gains and the Biden Tax Plan.

Ad Make Tax-Smart Investing Part of Your Tax Planning. On September 13 House Democrats proposed raising the top federal tax rate on long-term capital gains and qualified dividends from 20 to 25. Increasing top tax rates for individuals.

House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. Ad If youre one of the millions of Americans who invested in stocks. The tax hike would apply to households making more than 1.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. These are the current rules but the Biden administration has proposed some changes.

Proposed Changes to Capital Gains Tax. The proposed rules for disposals on or after 6 April 2023 will introduce a much more favourable tax treatment. Connect With a Fidelity Advisor Today.

The above illustration assumes the proceeds of disposition to be 200 with a capital gain of 100. Proposed capital gains tax. Separating spouses or civil partners be given up to three years after the year they.

The individual tax rate could just from 37 to 396 for those making more than 400000 annually. The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396. Long-term capital gains tax applies to appreciated assets sold after holding them for at least one year.

Or sold a home this past year you might be wondering how to avoid tax on capital gains. President Joe Biden proposed raising the top rate on long-term capital gains to 396 from 20. Raising the top capital gains rate for households with more than 1 million.

As you can see the end result shows that the increase in the capital gains. Increase in Capital Gains Rate. It would apply to those with more than 1 million in annual income.

How Are Capital Gains Taxed Tax Policy Center

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

Capital Gains Full Report Tax Policy Center

Capital Gains And Capital Pains In The House Tax Proposal Wsj

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

The 6 Trillion Difference In Tax Policies Tsp Family Office

The National Economic Impacts Of Current Legislative Proposals To Change The Capital Gains Tax

Capital Gains Tax In The United States Wikipedia

Proposed Tax Changes And The Sale Of Your Practice Bridgeway Practice Transitions

Crunchbase Proposed Changes To Capital Gains Likely To Affect Early And Late Stage Vc Differently Wisconsin Technology Council

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Biden Capital Gains Tax Plan Could Raise 113 Billion If Step Up Is Killed

Crystal Gazing A Look At The Presidential Candidates Major Income Tax Proposals Pearl Meyer

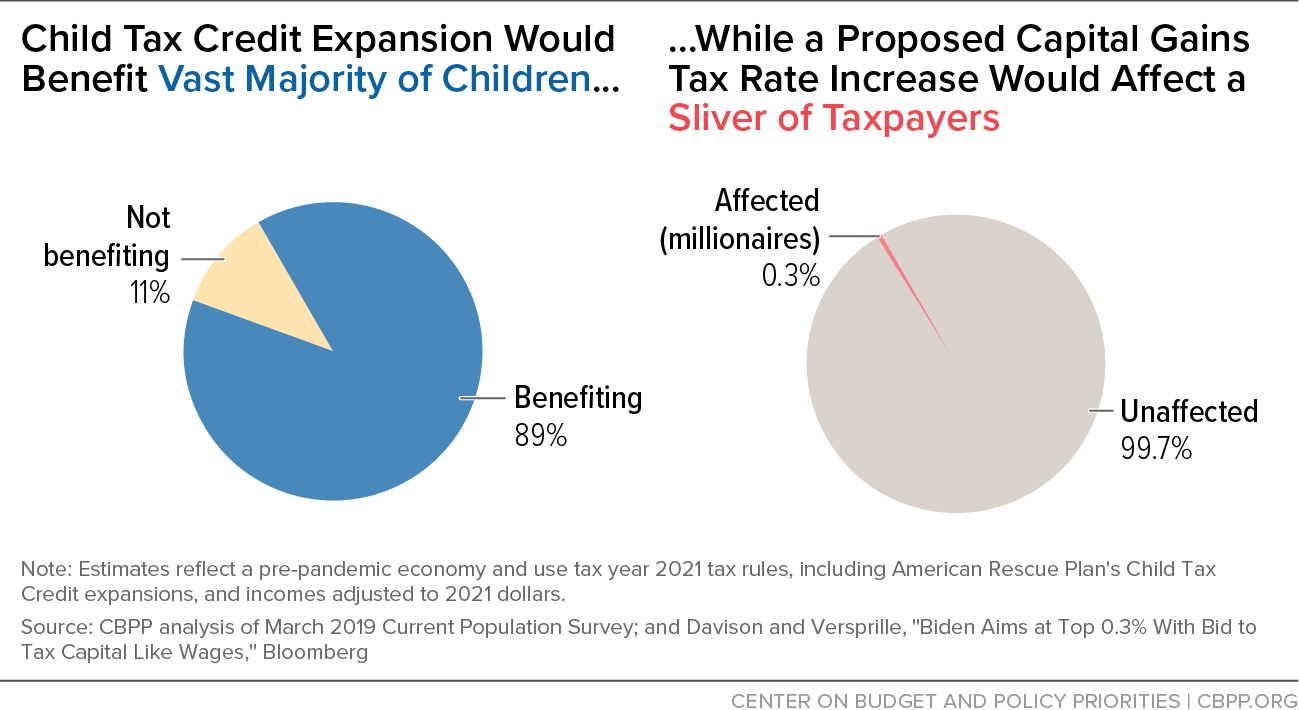

Child Tax Credit Expansion Would Benefit Vast Majority Of Children While A Proposed Capital Gains Tax Rate Increase Would Affect A Sliver Of Taxpayers Center On Budget And Policy Priorities

Potential Biden Proposed Tax Changes Becoming Clearer Amg National Trust

Structural Questions Abound With New Mark To Market Tax Proposal Foundation National Taxpayers Union

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Capital Gains Tax Proposal Spurs Car Dealers To Merge Automotive News